Household Budgeting For Seniors

Seniors get into financial trouble when they lose track of where their at versus where they need to be. In other words, if you don’t know what you’re spending, it’s easy to over or under spend. Both increase the likelihood of bad outcomes. Household budgeting for seniors is the best way to get somewhere is to know where you’re at today. Creating a household budget is the best way to plan and manage your finances.

What Is A Household Budget

A household budget for seniors examines income for seniors (or senior households for couples or intergenerational families) and their expenses on an annual, quarterly, and monthly basis. In other words, the budget is prepared to help the senior(s) assess what they can spend based on their income and expenses. The budget is especially useful over time. First, as we age, seniors need greater medical resources often associated with higher expenses. Second, seniors often have higher housing expenses when they age. Especially if they need in-house help.

Our Finances Section will teach you how to create this budget, and how to use it to better prepare for the future and manage your day-to-day finances. See Finances Section.

Income For Seniors

Income is what a senior has to spend. For seniors, income in retirement household budgeting includes things like social security, disability insurance, annuities, pension plans, and reverse mortgages. It may also include earned income for working seniors. Additionally, at CarePlanIt we like to break down income into recurring sources of income, government assistance (excluding SSI and DSI), investments, trusts, and untapped sources of income. See our section on Retirement Income for details here.

Expenses For Seniors

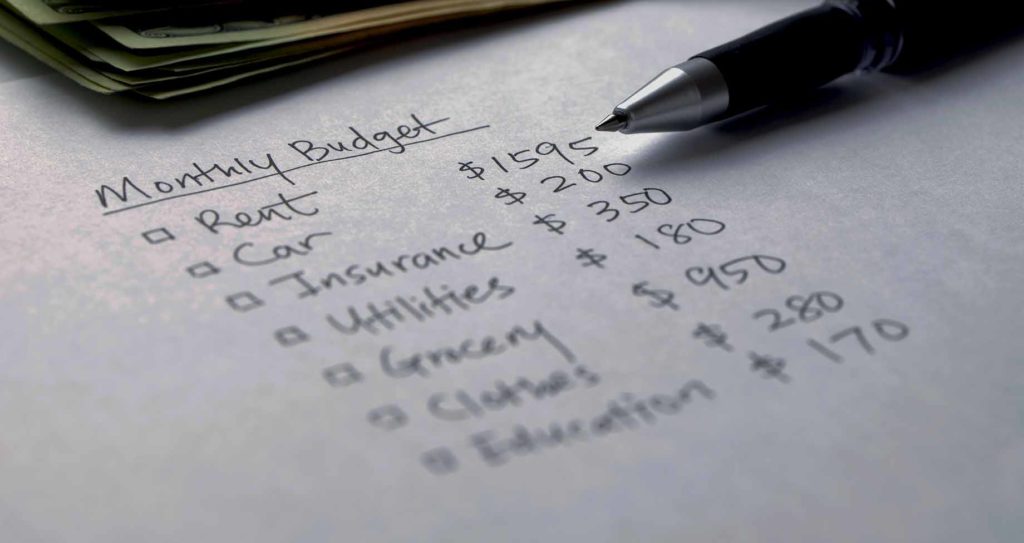

Unlike income, expenses are subtractions from a senior’s income. Expenses in retirement vary for every senior. However, there are averages and key categories. Importantly, the big four expense categories for household budgeting are housing, food and entertainment, transportation, and healthcare. See our section on How Much We Spend In Retirement for details here.

Household Budget For Seniors

Last but not least, putting the “income” and “expenses” together results in the senior’s household budget. The budget helps a senior assess their monthly, quarterly, or annual spending. Overspending is a sign to slow spending. In contrast to overspending, underspending is a sign that the senior can spend more. See our section on How To Create A Retirement Budget for details here.

Other Resources For Household Budgeting

See our Finance Section here.

See the National Council on Aging section on financial education here.