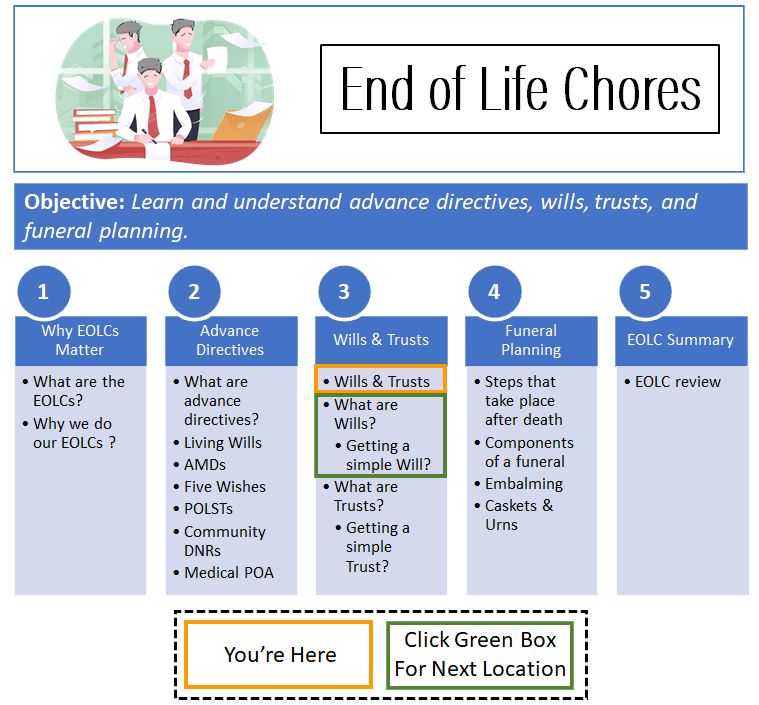

Wills & Trusts

Click here to see what's on this page.

Wills and Trusts are part of estate planning. For example, these documents allow you to determine how your assets are distributed and managed after death. However, they must be written. An oral explanation is not enough.

History of Wills

Historically, a written will was not very common. Reasons included illiteracy, limited property ownership (not much to bequeath) and a reliance on oral communication. Instead, ecclesiastical rules, manorial traditions, and government rules governed inheritance.

It is a relatively recent phenomenon that people can choose to give away their property after death. Americans can control their wealth after death. However, they must use tools like Wills and Trusts. Otherwise, the government steps in and determines how your possessions are disbursed and taxed based on government rules of succession.

Inheritance Laws & Wills

Modern inheritance laws benefit individuals that plan. Wills and Trusts are easy to create. For example, a will allows people to direct how they want their possessions disbursed after death. Similarly, a trust can be used to sidestep probate and minimize taxes.

Probate

The state’s management process of inheritance is called probate. Probate is the court proceedings that govern inheritance. It is a proceeding to prove that there is a valid will of the deceased.

In this sense, the State can guarantee that the deceased Will is followed. Most States want a chance at obtaining for itself, the assets of the deceased. It, therefore, makes sense to put itself at the center of a legal transfer from the deceased to the deceased’s beneficiaries.

Trusts Allow You To Sidestep Probate

A trust allows you to sidestep probate. If your assets are in a trust after you die the trust owns the assets, not you. There are other ways to sidestep probate. These usually involve ongoing ownership of the asset, at your death, of another. Some of these techniques include:

How a person chooses to disperse of their property after death is legally documented by a will or testament. A will-maker is called a testator, or testatrix if a woman. The process of managing this disbursement is given to an executor.

NOTE: If you have assets of more than $100,000 or a desire to distribute your assets in a tax-efficient or complicated manner, you should see an attorney.

Common Terms

Administrator / Administratrix

Male / female person appointed to administer an estate. The term administrator is the modern usage for male or female. In other words, the person responsible for managing the trust.

Beneficiary

Any person receiving a gift or benefit from a will or trust.

Bequest or Legacy

A gift of personal property left at death. Codicil – a modification or amendment to a will.

Decedent

A dead person, a person no longer alive, the deceased.

Demonstrative Legacy

A gift of money of a certain amount (demonstrative) with instructions on how to pay it out. Often included information of what fund or source to use (i.e., sell the house and distribute 1/3 to each of my children).

Descent

A gift or succession of real property.

Devise

The historical term used to describe a testamentary gift or a gift of real property. Current terms are bequest or legacy.

Devisee

The recipient or beneficiary of real property.

Distribution

Succession to personal property.

Executor/executrix or personal representative [PR]

This is the person who manages or administers the estate. The estate is also subject to the supervision of the probate court. The will-maker (testator) almost always selects an executor in the will.

Exordium Clause

First paragraph in a will where the testator identifies himself, states a legal domicile, and revokes any prior wills.

Inheritor

A beneficiary. In both testate and intestate situations.

Intestate

When a person dies without a will, they are die intestate. If you die without a valid will (intestate), your assets are distributed according to state law.

Legacy

A gift of personal property left at death, usually money.

Legatee

The beneficiary of a legacy – someone getting personal property pursuant to a will.

Probate

A court proceeding to prove the validity of a will. The process starts with the will, and request for the appointment of the named executor (or an administrator if no executor). In probate, the court will: validate the will, identify the deceased property, appraise the property, settle debts, pay taxes, and disburse the property. However, if there is no will the court will settle via the state laws of intestate.

Testate

Dying with a valid will is dying estate. In other words, you die with a will.

Testator / testatrix

Male / female who executes or signs a will; that is, the person whose will it is: the will-maker. Today, both sexes use the term testator.

Trustee

A Trustee is a person who acts as the custodian for the assets held within a Trust.

Other Resources On Wills & Trusts

Interesting resource on Trusts and Wills here.

For a sample Will, click here.