THE EXAMPLE BELOW IS FOR INFORMATIONAL PURPOSES ONLY. ALWAYS CONSULT AN ESTATE PLANNING LAWYER TO ASSIST YOU IN MAKING TRUSTS.

LIVING TRUST OF GARY GRANTOR

By

Gary Grantor

I, GARY GRANTOR (or “GG”), a resident of Los Angeles California, declare this to be my Living Trust and hereby revoke any previous Living Trusts and Wills that I may have previously made.

Article I – Identification

- The Grantor (aka “Settlor” or “Trustor”) of this trust is GG

- The Grantor has three living children, Little Gary 1 (LG1), Little Gary 2 (LG2), and Little Gary 3 (LG3).

- This Trust shall be known as the LIVING TRUST OF GARY GRANTOR

ARTICLE II – FUNDING OF THE TRUST

The Grantor makes payable to the Trustee the assets listed on the attached Schedule “A”. This Schedule may be revised at any time as assets are made payable to the Trustee or transferred to the Trustee. Those assets, all additional property received by the Trustee from any person by will or otherwise, and all investments and reinvestments thereof are herein collectively referred to as the “Trust Estate” and shall be held upon the following trusts.

ARTICLE III – APPOINTMENT OF TRUSTEES

The Grantor hereby appoints himself, GG, as Trustee of this Living Trust. In the event that he is unwilling, unable, or does not accept his appointment, Grantor hereby appoints LG1 to serve as Alternative Trustee of this Living Trust or any trust created hereunder, and if LG1 is unwilling, unable, or does not accept his appointment, Grantor hereby appoints LG2 to serve as Alternative Trustee of this Living Trust or any trust created hereunder. And if LG2 is unwilling, unable, or does not accept his appointment, Grantor hereby appoints LG3 to serve as Alternative Trustee of this Living Trust or any trust created hereunder.

ARTICLE IV – PAYMENT OF EXPENSES

- The Trustee will pay from the Trust Estate all expenses related to the Grantor’s last illness and funeral; all Grantor’s legally enforceable debts; administration costs including ancillary costs; costs of administering and delivering legacies; other proper charges against Grantor’s estate; estate and inheritance taxes assessed by reason of the Grantors death, except that the amount, if any, by which the estate inheritance taxes shall be increased as a result of the inclusion of the property. Interest and penalties concerning any tax shall be paid and charged in the same manner as the tax. Grantor waives for his estate all rights or reimbursement for any payments made pursuant to this article.

- The Trustee’s may choose what assets to sell in order to make foregoing payments or to satisfy any pecuniary legacies, and tax effects. These decisions are not subject to my beneficiaries.

- The Trustee shall make elections under the laws as the Trustee deems advisable, without regard to the relative interests of the beneficiaries. No adjustment shall be made to principal or income or in the relative interests of the beneficiaries to compensate for the effect of elections under the tax laws made by the Trustee.

ARTICLE V – TRUST PROVISIONS FOR INCOME AND PRINCIPAL

The Trustee will hold, manage, invest and reinvest the Trust Estate as described herein and will collect income, if any, therefrom and will dispose the net income and principal as follows:

- The Trustee will use (pay to or apply) for the benefit of the Settlor, during the lifetime of the Settlor, all the net income from the Trust.

- The Trustee will use (pay to or apply) for the benefit of the Settlor, during the lifetime of the Settlor, the sums from the principal of this Trust as in its sole discretion shall be necessary or advisable from time to time for the medical care, comfortable maintenance and welfare of the Settlor.

- The Settlor may at any time during his/her lifetime withdraw all or part of the principal of this Trust, by delivering an instrument in writing duly signed by him/her to the Trustee, describing the property or portion thereof desired to be withdrawn. Upon receipt of such instrument, the Trustee shall thereupon convey and deliver to the Settlor, the property described in such instrument.

- In the event that the Settlor is declared by a court to be incompetent; or by reason of illness, or mental or physical disability is, in the opinion of the Trustee, unable to properly handle his/her own affairs, the Trustee may use the payments of income and principal for the benefit of the Settlor.

- The interests of the Settlor will be considered before (i.e., primary and superior) the interests of any beneficiary.

ARTICLE VI – ADDITIONAL TRUST POWERS

In addition to the powers granted in this document or under applicable law or otherwise, the Trustee is authorized to exercise the additional following powers.

- Acquire, Sell and Hold Property. To hold and retain any and all property, real, personal, or mixed, received from the Settlor’s estate, or from any other source, regardless of any law or rule of court relating to diversification, or non-productivity, for such time as the Trustee shall deem best, and to dispose of such property by sale, exchange, or otherwise, as and when they shall deem advisable; not withstanding this provision or any other contained herein.

- Manage Property Transactions. To sell, assign, exchange, transfer, partition and convey, or otherwise dispose of, any property, real, personal or mixed, which may be included in or may at any time become part of the Trust Estate, upon such terms and conditions as deemed advisable, at either public or private sale, including options and sales on credit and for the purpose of selling, assigning, exchanging, transferring, partitioning or conveying the same, to make, execute, acknowledge, and deliver any and all instruments of conveyance, deeds of trust, and assignments in such form and with such warranties and covenants as they may deem expedient and proper; and in the event of any sale, conveyance or other disposition of any Trust Estate, the purchaser shall not be obligated in any way to see the application of the purchase money or other consideration passing in connection therewith.

- Manage Property. To lease or rent and manage any or all of the real estate, which may be included in or at any time become a part of the Trust Estate; to review and modify such leases; and for purpose of leasing said real estate, to make, execute, acknowledge and deliver any and all instruments in such form and with such covenants and warranties as they may deem expedient and proper; and to make repairs, replacements, and improvements, structural and otherwise, of any property, and to charge the expense thereof in an equitable manner to principal or income, as deemed proper.

- Indebt Trust Estate. To borrow money for any purpose in connection with said Trust; and to execute promissory notes or other obligations for amounts so borrowed; and to secure the payment of any such amounts by mortgage or pledge or any real or personal property; and to renew or extend the time of payment of any obligation, secured or unsecured, payable to or by any trust created hereby, for such periods of time as deemed advisable.

- Invest. To invest, reinvest or leave temporarily uninvested any or all of the funds of the Trust Estate including investments in stocks, common and preferred, and common trust fund, without being restricted to those investments expressly approved by statute for investment by fiduciaries, and to change investments from realty to personality, and vice versa.

- Claims. To deal with and settle claims (arbitrate, sue, defend, compromise, adjust, abandon, or otherwise) in favor of or against the Trust Estate as the Trustee shall deem best.

- Determine and Manage Costs and Expenses. To determine in a fair and reasonable manner costs, charges, expenses, taxes, or assessments shall be applied against income or principal, or partially against income and partially against principal.

- Hire and Manage Professionals. To engage and compensate, out of principal or income or both, attorneys in-fact, attorneys-at-law, tax specialists, agents, accountants, brokers, realtors, investment counsel, custodians, and other assistants and advisors, so long as retained and managed with reasonable care.

- Vote and Use Proxies To Vote. To vote any stock, bonds, or other securities held by the Trust an any meetings of stockholders, bondholders, or other security holders. To delegate the power to vote to attorneys-in-fact or proxies under power of attorney, restricted or unrestricted, and to join in or become a party to any organization, voting trust, consideration or exchange. To deposit securities with any persons, and to pay any fees incurred in connection therewith, and to charge the same to principal or income, as deemed proper, and to exercise all of the rights with regard to such securities.

- Purchase Assets To Settle and Manage Trust Objectives. To purchase securities, real estate, or other property from the executor or other personal representatives of the Settlor’s estate, and the Trustee of any agreement or declaration executed by the Settlor during his/her lifetime under his/her last will in case his/her executors or Trustees are in need of cash, or income-producing assets with which to pay taxes, claims, or other estate or trust indebtedness. The same is authorized if executors or Trustees are in need of such property to properly exercise and discharge their discretion with respect to distributions to beneficiaries as provided for under such bills, declarations, or agreements. Such purchase may be in cash or may be in exchange for other property of this Trust. In all cases the Trustees shall not be liable in any way for any loss resulting to the Trust Estate by reason of the exercise of this authority.

- Incidental Acts. To engage in further acts as are incidental to any of the foregoing or are reasonably required to carry out the tenor, purpose and intent of the Trust.

- Lending to Trust Representatives. To make loans or advancements to the executor or other personal representative of the Settlor’s estate and the Trustees of any agreement or declaration executed by the Settlor during his/her lifetime or under his/her last will in case such executors or Trustees are in need of cash for any reason. Such loans or advancements may be secured or unsecured, and the Trustees shall not be liable in any way for any loss resulting to the Trust Estate by reason of the exercise of this authority.

ARTICLE VII – TRUST ASSETT DISBURSEMENT UPON DEATH

Upon death of the Settlor, the remaining Trust assets shall be distributed pursuant to Schedule B. If any beneficiary and the Settlor should die under such circumstances as would render it doubtful whether the beneficiary or the Settlor died first, then it shall be conclusively presumed for the purposes of this Trust that said beneficiary predeceased the Settlor.

ARTICLE VIII – RULE AGAINST PERPETUITIES

If any provisions of the Trust violates any rule against perpetuities or remoteness of vesting now or hereafter in effect in a governing jurisdiction, that portion of the Trust herein created shall be administered until the termination of the maximum period allowed by law. After which the Trust shall be distributed in fee simple to the beneficiaries then entitled to receive income, and for the purpose, it shall be presumed that any beneficiary entitled to receive support or education from the income or principal or any particular fund is entitled to receive the income therefrom.

ARTICLE IX – PLEDGING OF ASSETS

Except as otherwise provided herein, all payments of principal and income payable, or to become payable, to the beneficiary of any trust created hereunder shall not be subject to anticipation, assignment, pledge, sale or transfer in any manner, nor shall any said beneficiary have the power to anticipate or encumber such interest, nor shall such interest, while in possession of the Trustee, be liable for, or subject to, the debts, contracts, obligations, liabilities or torts of any beneficiary.

ARTICLE X – GOVERNING LAWS

This Trust Agreement shall be construed, regulated and governed by and in accordance with the laws of the State of [Select Your State]. I certify that I have read the foregoing Trust Agreement and it correctly states the terms and conditions under which the Trust Estate is to be held, managed and disposed of by the Trustee.

Dated: _________

[Settlor’s Printed Name]

____________________________________

[Settlor’s Signature]

Dated: _________

____________________________________

[Trustee’s Printed Name]

____________________________________

[Trustee’s Signature]

WITNESSES

The foregoing instrument, consisting of _____ pages, including this page, was signed in our presence by _____________________ on ________________ [name of Settlor]. We, at the request and in the presence of the Settlor and in the presence of each other, have subscribed our names below as witnesses. We declare that we are of sound mind and of the proper age to witness a revocable trust, that to the best of our knowledge the Settlor is of the age of majority, or is otherwise legally competent to make a revocable trust, and ap pears of sound mind and under no undue influence or constraint. Under penalty of perjury, we declare these statements are true and correct on this day of _________ ,2019 at ____________________.

First Witness

Date: ___________

Sign your name: _________________________

Print your name: _________________________

Address: _______________________________

City:_____________________

State:____________________

Second Witness

Date: ___________

Sign your name: _________________________

Print your name: _________________________

Address: _______________________________

City:_____________________

State:____________________

Certificate of Acknowledgement

State of

County of

On____________(date),

before me, _______________________(notary),

personally appear________________________________(signers),

□ personally known to me

OR

□ proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s) or the entity upon behalf of which the person(s) acted, executed the instrument

WITNESS my hand and official seal

________________________________________

(notary signature)

NEW PAGE

Schedule A

Description of Property

[Insert description of the property to be placed in the revocable trust.]

Things in this schedule should be bank accounts (checking and savngs), brokerage accounts, annuities and property.

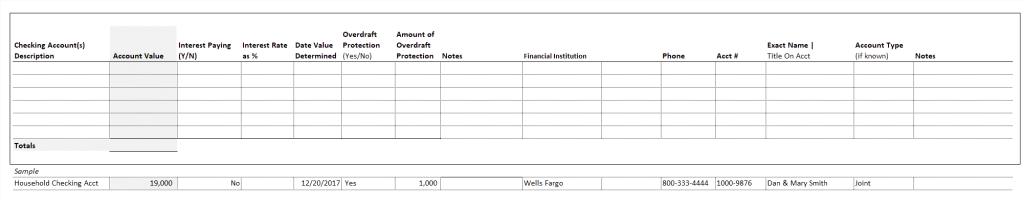

Checking Account

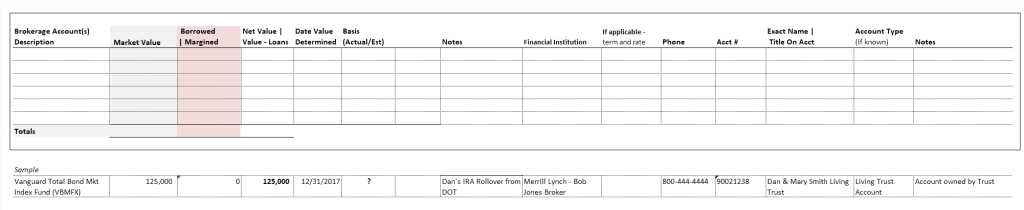

Brokerage Accounts

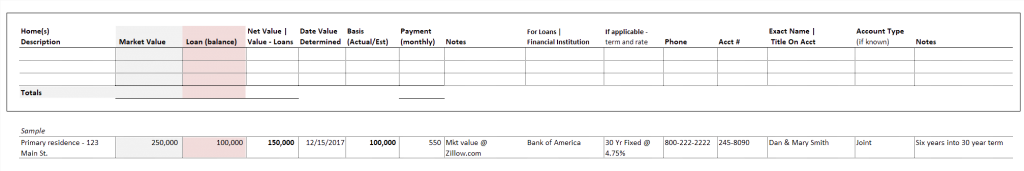

Property

New Page

Schedule B

The value of the Trust shall be distributed to my children who survive me in the following manner:

- The value of this Trust shall be totaled

- This Trust shall be divided equally between LG1, LG2 and LG3

The value shall be divided among my children by my executors in their absolute discretion after consultation with my children. My executors may pay out of my estate the expenses of delivering tangible personal property to beneficiaries.