Retirement Spending – How Much Can I Spend?

Click here to see what's on this page.

As adults, we spend most of our time earning money. As seniors, we spend it. Carmen and I learned while studying senior behavior patterns that spending habits are remarkably stable year to year. It doesn’t mean you can’t spend less; it just means that you’re likely to spend the same amount year to year without a concerted effort to change your spending habits. This means retirement spending is not likely to change that much from your non-retirement spending. The real challenge is the expenses that are likely to increase with age. Expenses related to health care, medications, and in-home health support.

How much we spend in our retirement years is a big part of what we need in retirement and how long our resources will last. For illustrative purposes, let’s say I have resources equal to 100. I will call them units. If I spend 10 units a year, my resources last 10 years. If I spend 5 units, my resources last 20.

In this section, we’ll teach you a technique to estimate your spending in retirement and compare it to your current spending habits. If you’re currently retired, you’ll discover both simultaneously.

Retirement Spending Lessons From The Super Agers

Almost all the Agers Carmen and I talked to were concerned about running out of money. The Super Agers were different. They studied how they spent their money and felt confident this knowledge would help them in retirement. They weren’t worried about overspending. It didn’t mean they wouldn’t run out of money; it simply meant they had their hands around their spending habits. This knowledge allows them to rationally assess when and how they might run out of money.

If they need to spend less, they know how much less. If they can spend more, they know how much more. Knowing their budget now and their possible budget in the future made this possible.

What Do Average American Spend In Retirement?

You are not “average.” You and your senior household are unique. That’s why you must assess your specific situation and not rely on someone else’s spending patterns to estimate what you’ll spend. That said, you can use some rule of thumb and look at national averages to see if your numbers seem at odds with common sense and national averages.

The Big Four Expenses

The big four expenditures are housing, food, transportation, and healthcare. We’ll cover those at a high level to get you started.

To keep things in a reasonable perspective, it helps to look at national averages as percentages of total expenditures. In other words, what percentage does a category make up of total expenditures? This is helpful because most of us can make a reasonable guestimate of what we will earn a year, and looking at what percentage key categories make up gives us a rough estimate of where we should be if we track near the national average. Information presented comes from the government publication found here.

Housing

Housing is the major retirement spend for seniors. This category represents 30 percent of a senior household’s income. Expenses in this category include mortgage, rent, home insurance, and maintenance. When you use CarePlanIt categories we also add furnishings, appliances, lawn care, and house cleaning. Our categories allow a senior to track and compare the costs of their current home to what it might cost to move to an assisted living facility.

Food And Entertainment

Nationally, seniors spend about 12% of their retirement income on food and 4% on entertainment. CarePlanIt categorizes these together because a big chunk of entertainment is going out to dinner. A great rule of thumb is a day’s meals run $9 a person. That’s $3,285 a year per person or $6,570 per couple. Eating out can easily add another $1,200 a person or $2,400 a couple.

Transportation

On average, a senior household spends about 12.8% of their annual income on transportation. This includes insurance, gas, and loan (or lease) payments. This comes to about $7,500 a year.

Healthcare

Senior households spend about $7,000 a year on healthcare. This includes costs for Medicare, co-pays, medications, dental, ear, and eye care.

How Much Do We Spend Now?

To manage retirement spending successfully, getting your hands around spending is the single most important issue to understand. Knowing what you’ll spend will inform you about when you’ll likely run out of money in retirement. To determine this, we need you to identify all your likely expenses. These are basically expenses associated with maintaining your household. If you’re married, expenses need to include you and your wife’s expenses, but if you’re single, it’s just your expenses.

If you’re living with a child or grandchild and this relationship is expected to continue in retirement, include expenses you spend related to this relationship.

Retirement Spending Categories

Carmen and I have thought a lot about retirement spending categories. We focus on categories that tie to retirement. These categories may not be relevant for you today, but they are very likely to be relevant in the future. We ask that you make an effort to estimate what expenses might look like in the future, so you don’t underestimate your spending needs over time.

Once collected, you’ll categorize them into the following ten categories

- Live in care (or day care supporting the daily living needs of the care recipient)

- Housing Expenses

- Utilities

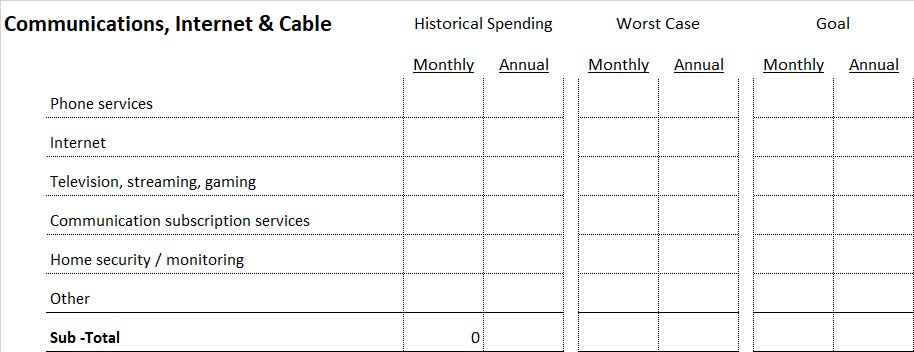

- Communications

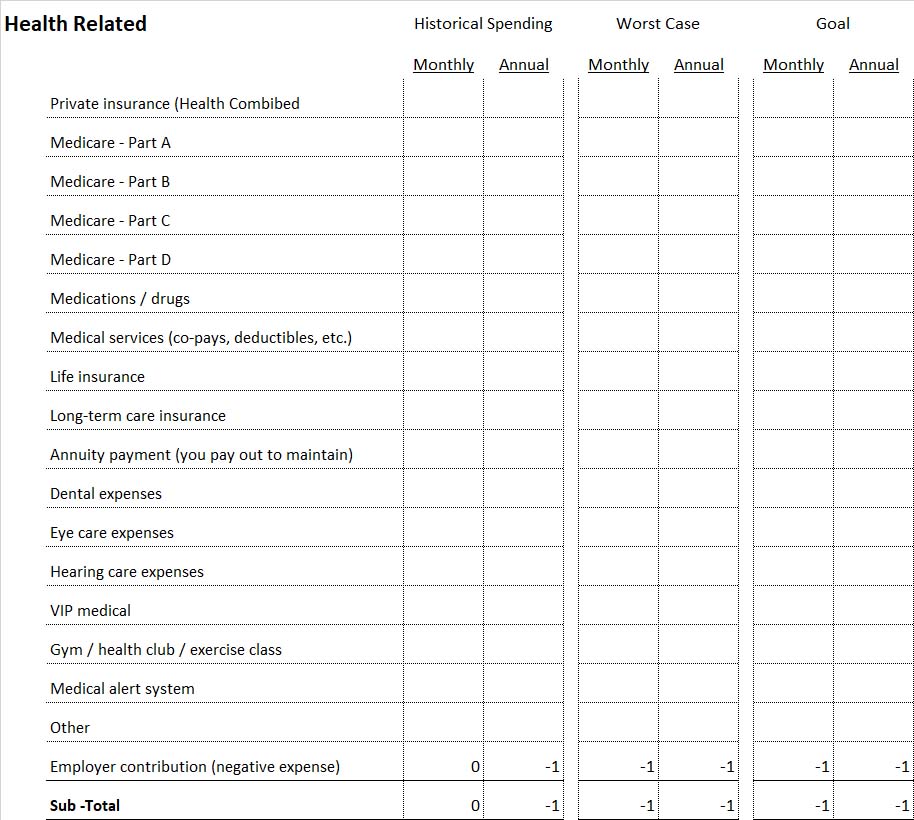

- Health Related

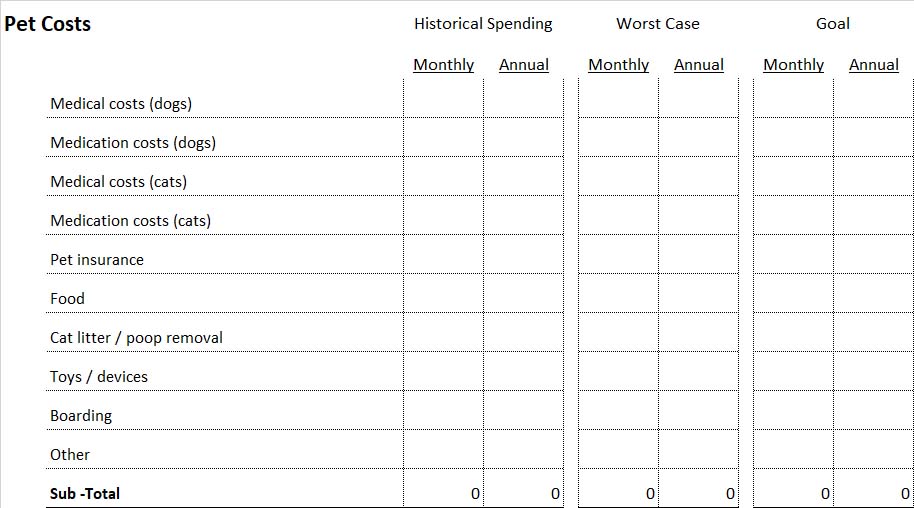

- Pet Costs

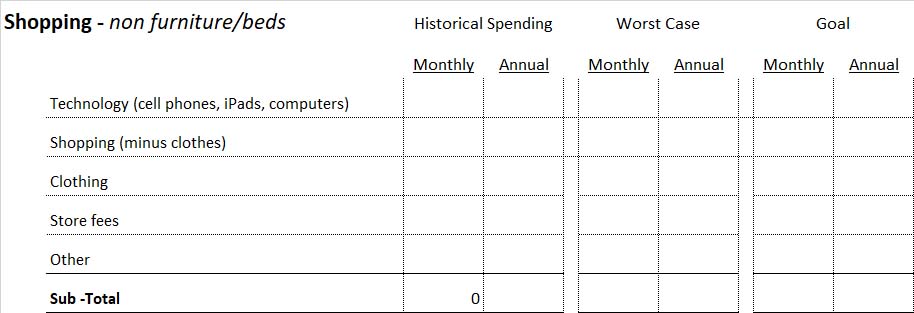

- Shopping

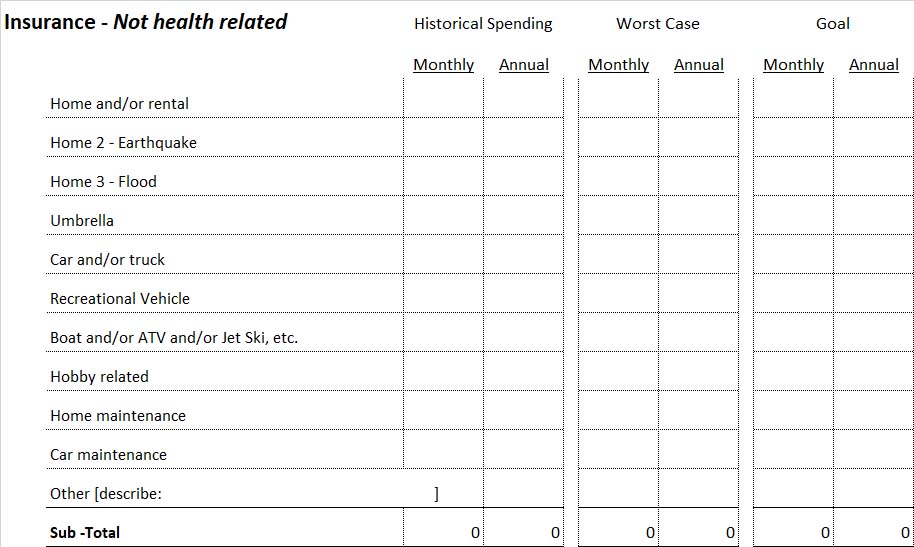

- Non-Health Insurance

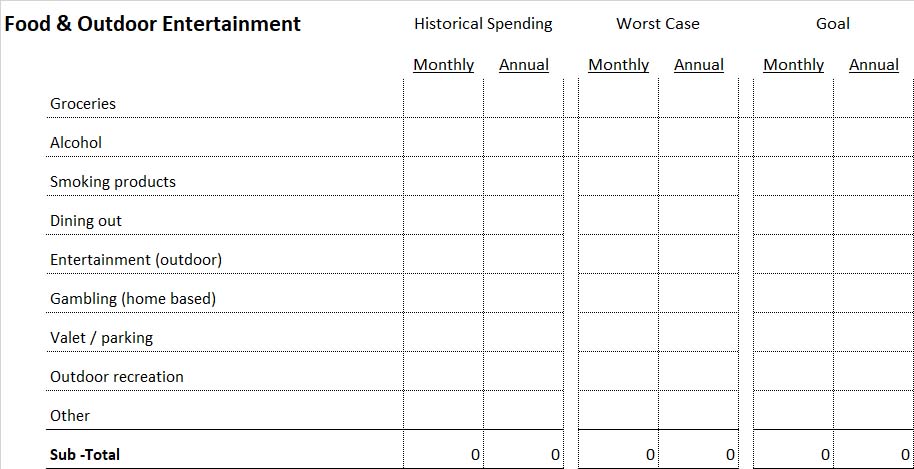

- Food and Outdoor Entertainment

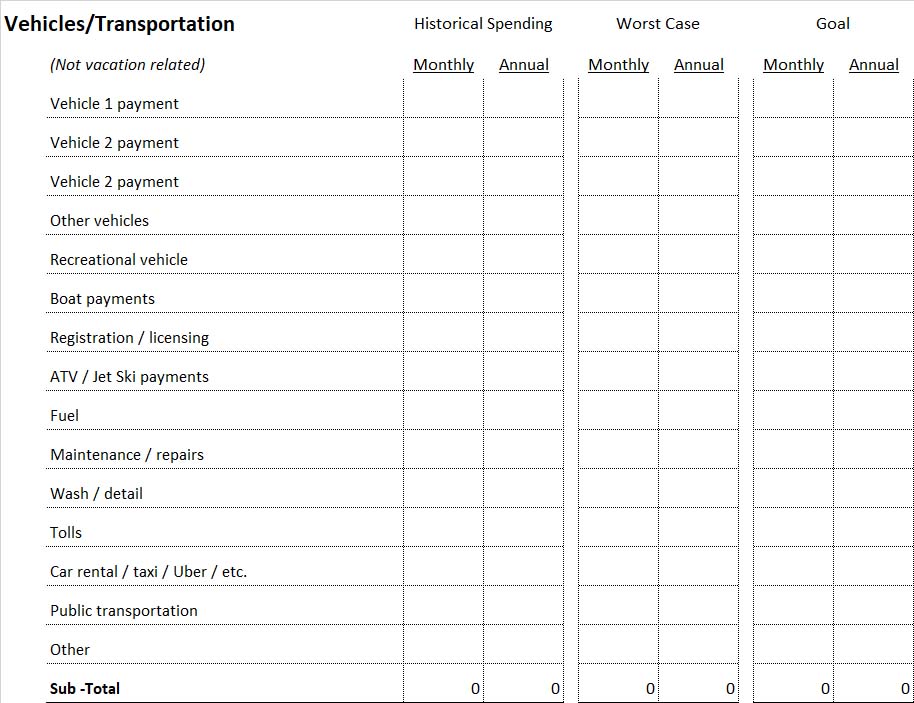

- Vehicle/Transportation

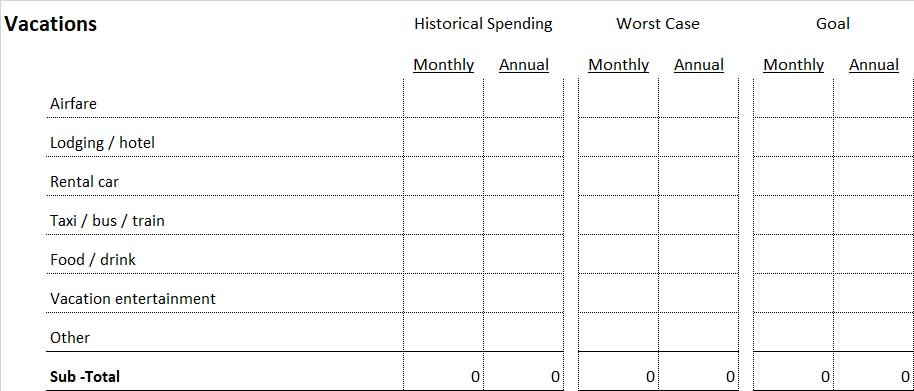

- Vacations

- Other Common Expenses

Don’t worry about these categories now, it is more important to get an accurate list of all expenses. Let’s start.

Now that you have collected the expenses, please fill out the charts below.

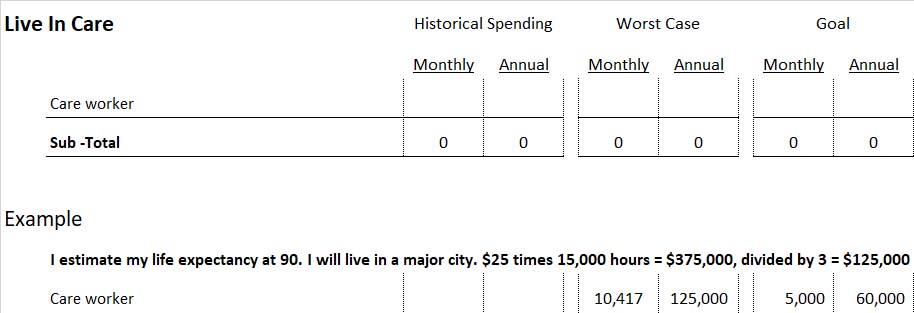

Retirement Spending For Live-In Care

At some point, most families need some form of live-in care to help with activities of daily living (ADL). These are things like bathing, meal preparation, toileting, and transportation. Sometimes a spouse or child can provide this care. In other cases, a caregiver may be hired to provide these services. Caregivers cost between $100 and $200 a day ($36,500 – $73,000 a year).

Hint: If the care recipient has had any serious health issues and the spouse or child cannot bath, carry and help with toileting, add at least 30 days at $150 ($4,500) in the “Worst Case” section. Carmen and I use $27,375 to cover half a year of assistance in our “Worst Case” section for retirement spending.

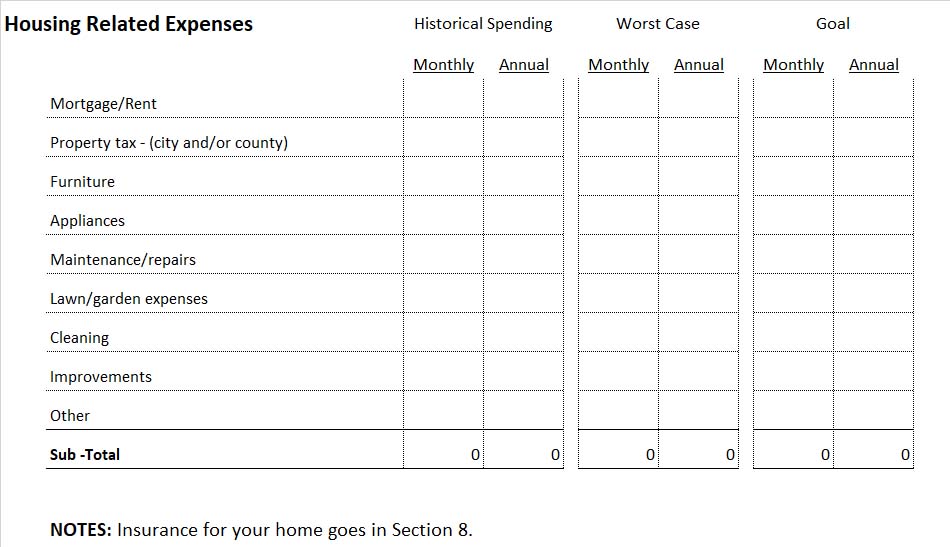

Housing Expenses

Like live-in care costs, housing costs are also a large percentage of a senior’s household expenditures.

Housing expenses for this category are those expenses that support the physical aspects of your home and yard. Retirement spending must account for these expenses. Property taxes are also included and may be levied by the city and/or county. Don’t forget budgets for furnishings and appliances; they wear out. Also, annual “Maintenance/Repairs” costs should be calculated at between 1% and 3% of your home’s value. For example, using 2%, the annual costs for a home valued at $250,000 would be $5,000.

Hint(s): Don’t double count insurance expenses. Mortgage payments often include costs related to insurance. Be sure and remove these costs from this section and include them in the insurance section.

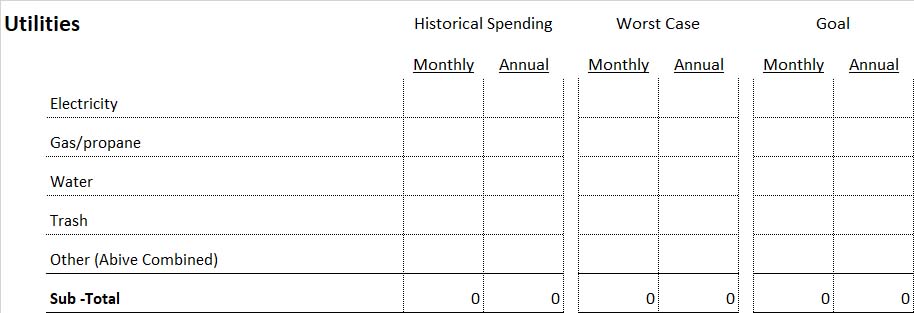

Utilities

“Utilities & Communications” contain your monthly expenses related to your home and those in-home requirements like medical alert systems and phone service.

Communications

Health-Related Retirement Spending

Health-related expenses are also a big piece of a senior’s expenses.

Health-related expenses include all health-related expenses except for “health insurance premiums,” which are categorized below under “Insurance.” Remember all co-pays and over-the-counter drugs. Keep in mind that dental expenses for the elderly can be costly (a crown runs around $500, bridges and dentures around $2,500). Retirement spending cannot ignore health-related expenses.

Pet Related

Pet costs are easy to forget. However. most of us own pets and they have real costs.

Shopping (non-home-related)

Insurance

Don’t forget to include any Medicare and Medicare supplemental insurance premiums. In many states, insurance companies will not cover risks from flooding, earthquake, or fire, and the State provides alternative insurance. All non-health-related insurance premiums should be included.

Hint(s): Don’t double count insurance expenses. Mortgage payments often include costs related to insurance. Be sure and take these out.

Food And Outdoor Entertainment

Vehicle & Transportation Retirement Expenses

Retirement spending on transportation is an integral part of living expenses. If you’re driving a vehicle, make sure you include the maintenance costs. For cars under 10 years old, use at least $1,000; for those over 10 years, use at least $2,000. Remember that even if you plan to give up your car, you’ll need to pay or tip someone who drives you around.

Vacations

The expenses above are among the most underestimated retirement spending category for seniors. It is common for seniors to spend a lot of time shopping. Seniors that don’t cook and use carefully prepared food lists tend to purchase lots of prepared food and overspend. Seniors can spend anywhere between $2 and $10 a meal. For a couple, the difference between $2 and $10 a meal is over $17,000.

Some seniors keep current with dues for professional societies (legal, accounting, financial, etc.) or may do part-time work requiring some sort of union dues or fees. These expenses are often due to a

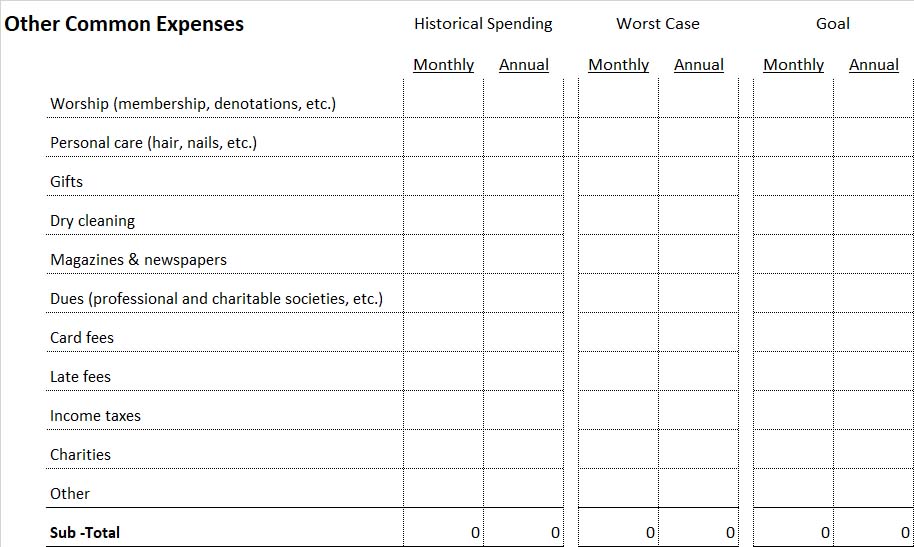

Other Common Expenses In Retirement

Seniors often develop retirement spending patterns that closely follow their life activities. Active seniors that spend time in Church will spend money related to those church and related church activities. Seniors spending more time at home will often spend based on television solicitations (home shopping, television ministries, etc.).

Hint: For income taxes, use what you paid last year if you’re on a fixed income. Otherwise, try and use a ratio. For example, if you reported $50,000 of adjusted gross income last year and paid $5,000 in taxes, use the ratio $5,000/$50,000 or 10% and apply it to your estimated adjusted gross income for this year. So if you estimate an AGI of $70,000, the 10% ratio would result in a $7,000 tax estimate. This estimate will always be wrong. Use it only as an estimate. Contact a tax professional for a more accurate estimate of your tax liability, or complete a tax form using your estimated information for the tax year in question.

CarePlanIt’s One Day Financial Audit

Carmen and I have put together a great guide to conducting a financial audit. We call it 0ne Day Financial Audit For Seniors. You can get access to it here.