Retirement Income – Common Sources

Click here to see what's on this page.

Retirement income comes in many forms. A good way to get your hands around how much you’ll get in retirement is to ask the question: What absolute sources of income will I have in retirement? Undoubtedly, this should include any source of income from which you’ll get or could get regular and recurring income. These include things like: social security, disability insurance, annuities, pension plans, and reverse mortgages.

We ask the earning question to determine how much money you’ll bring in each month. Some people have a wide variety of income sources. On the other hand, others only one or two. To help you estimate what you might have, we’ve broken down sources of revenue into the following categories.

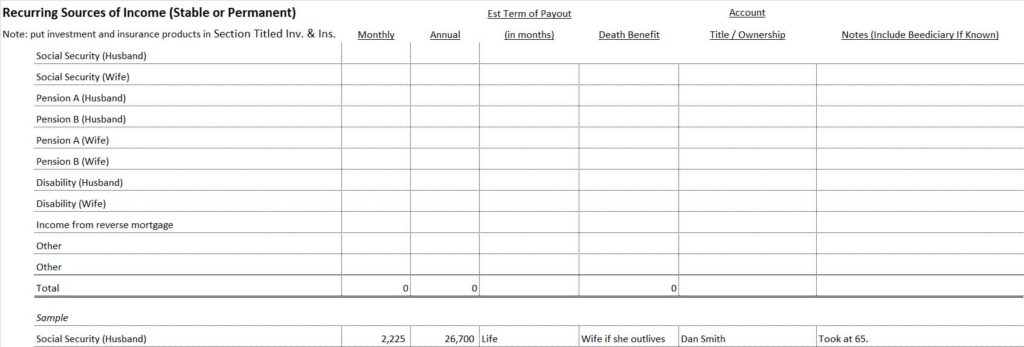

Recurring Sources of Retirement Revenue

CarePlanIt views recurring sources of retirement income as your stable monthly income sources. In other words, stable income sources. These include social security, disability insurance, pensions, and lifetime guaranteed income sources like a fixed amount lifetime annuity.

Think of these sources as your guaranteed monthly income. This income is fixed (i.e., the same each month). Increases are tied to cost of living adjustments (COLAs) or some other triggering event.

Defined-Benefit Plan

A defined benefit (DB) plan provides “defined” benefits to the retiree. This means the retiree knows the specific amount and type of benefits they get after retiring. DB benefits are tied to the length of time worked, salary, and management level (e.g., manager, director, vice president, etc.). The longer someone works in an organization, the larger DBs get. Time also implies the retiree spent a significant portion of their life with the employer. Consequently, BDs represent a significant percentage of retirement income for people that have them.

For example, a simple DB plan might guarantee an employee 50% of their average salary over their last three years of employment after twenty years of services, 60% after twenty-five years, and 70% after thirty years. Health benefits for the employee and their spouse are tied to their management level. For example, a basic employee may get a low-cost health package for themselves and their spouse until Medicare qualifying age. On the other hand, a vice president may get a premium health plan for themselves and their spouse for life.

DB plans used to be the most common. Many baby boomers are the beneficiary of these plans. However, in DB plans, the employer must take on the risk of paying out the committed benefit. If the investments made to fund the plan are less than the committed benefits, the employer must fund the difference. For this reason, most DB plans are terminated and replaced by defined contribution plans.

Defined-Contribution Plan

Unlike DB plans, a defined contribution plan (DC) does not guarantee the employee a specific benefit. DC plans identify the amount of funds that will go into a retirement account, not what the employee will receive upon retirement. The employee knows their contribution to the retirement fund and the amount matched or contributed by their employer.

The actual retirement benefit depends on how well the investments do over time. In other words, benefits are tied to the success of the investment between the contribution of the funds and the employee’s retirement.

Unlike DB plans, in the case of defined contribution plans, the employer is not at risk. The company has no obligation to pay a specific amount to the employee. The employee bears the risk of the account not generating the expected retirement income.

Social Security Income

Social Security is the common term for the United States’s retirement program. The term refers to the federal Old-Age, Survivors, and Disability Insurance (OASDI) program. Consequently, the Social Security Administration (SSA) administers the OASDI. The SSA administers retirement, survivors, and disabled social insurance programs. These programs pay monthly benefits to aged and disabled workers, their spouses and children, and the insured workers’ survivors. Taxes paid by employers and employees fund most of these programs. Collectively these programs are known as Retirement, Survivors, Disability Insurance (RSDI). In fact, for most Americans, OASDI benefits represent the biggest portion of their retirement income.

Average Social Security Income In Retirement

For example, in 2021, about 65 million Americans received Social Security benefits. Retired workers represent 46 million of this total. Their average monthly benefit is $1,544. That’s $18,528 a year. You can calculate your actual benefit by visiting the SSA site here.

Supplemental Security Income (SSI)

There is another program for indigent seniors. It is the Supplemental Security Income (SSI) program. This is a needs-based program for the aged, blind, or disabled. You can apply for SSI here.

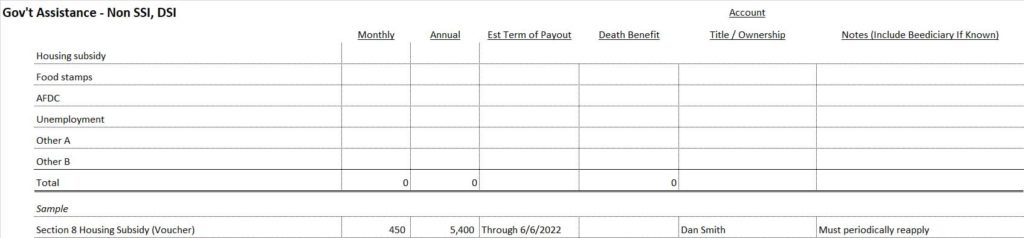

Government Assistance (not including SSI and DSI)

Many Agers receive government assistance unrelated to Social Security or disability. These government programs focus on people’s needs. These include, for example, things like housing assistance, food assistance, aid to families with dependent children in the household, and unemployment insurance. As a result, government programs and seniors’ greatest expense categories match. We discuss seniors’ biggest expenses here.

These benefits are recurring but not necessarily permanent forms of assistance. These programs require recipients to apply. Recipients must update and resubmit their applications for periodic review. Technically this isn’t retirement income, but it supplements your monthly needs.

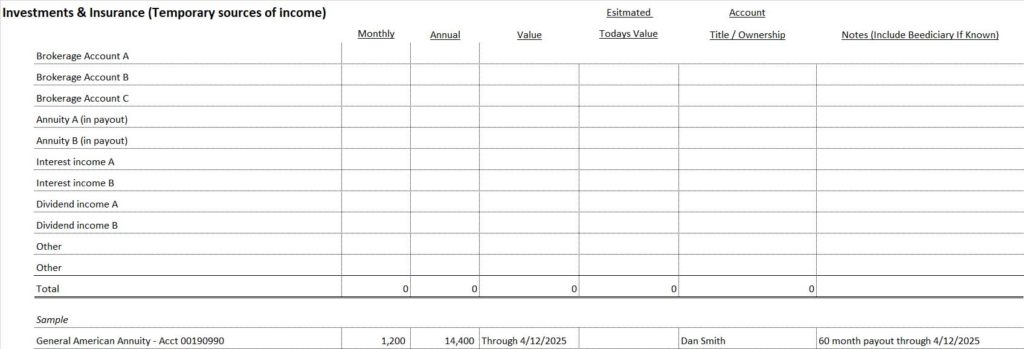

Investments

Investments like stocks, bonds, and certificates of deposit have principal value and often a dividend or interest component. These investments are generally held in brokerage or bank accounts. Summarizing them within these accounts makes sense. Annuities currently in repayment would also go here.

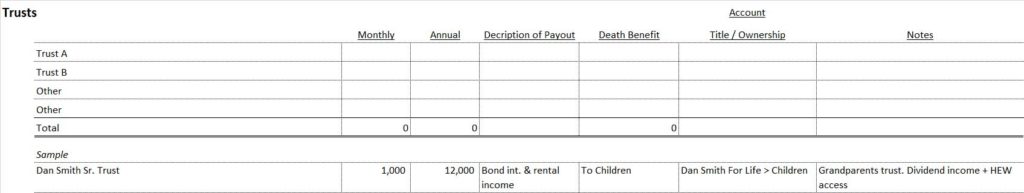

Trusts

A trust is a legal relationship that allows a third party to hold and manage assets on behalf of one or more beneficiaries. Trusts can be arranged in many ways and can specify how assets, or portions of assets, pass to the beneficiaries. Beneficiaries of a trust can receive many possible benefits. Trust benefits tend to be a bit unique, so we suggest they be listed separately.

Untapped Sources of Retirement Income

We all own assets that not used to generate current income. These types of assets include homes, cars, jewelry, and art. In addition, any insurance products not in payout should be here. These would include annuities, not in payout, and life insurance policies.

Seniors can convert these assets to generate revenue. For example, seniors can sell jewelry, insurance policies, and unused vehicles.

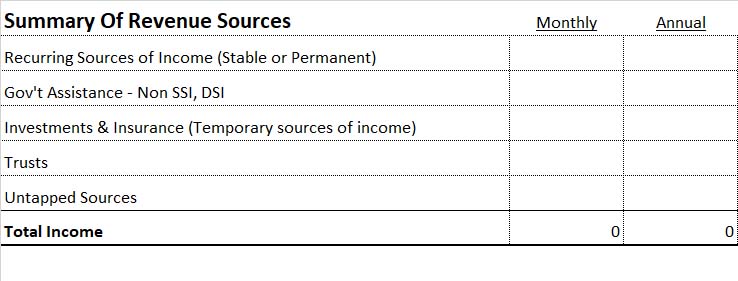

Retirement Income Sources Summary

CarePlanIt divides up sources of retirement income in a very specific manner. We look at the following sources. In parenthesis, we explain why we created the category.

Recurring Sources of Retirement Income

Government Programs

Unlike recurring sources of government income, the government also offers programs that require a recurring application.

Investments & Insurance

For some seniors, investments, and insurance also offer retirement income.

Trusts

Sometimes seniors also have access to trust funds.

Untapped Sources Of Retirement Income

Most seniors also have assets that can be converted to income.

Summary Schedule

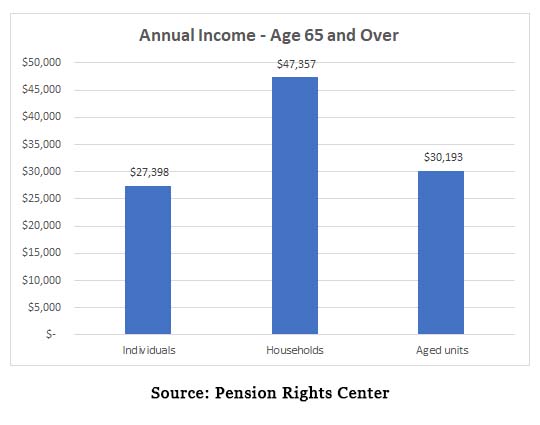

What Do Average Seniors Have As Retirement Income

Retirement income calculations are difficult. Determining average and income levels require decisions about variables. Are we looking at individuals, households over 65? What about over 65 versus over 75? Regardless what really matters is your retirement income, not someone else’s. Regardless, let’s look at some basic numbers.

In retirement, the annual income for individuals is $27,398, households $47,357 and Aged units $30,193. Individuals and households are self-explanatory. Aged units are a household where one senior is present, but younger non-spouses are also present.

Taxes On Retirement Income

Finally, remember that your retirement income is subject to taxes. Federal and state entities can and do tax retirement income. Federal and State entities, for example, calculate taxes on variables like retirement income and source of income. Where seniors live also matters. States tax retirement income differently. We discuss some of these details here.