Retirement Savings – What Will I Have In Retirement

Click here to see what's on this page.

Once again, don’t panic. You’ve found CarePlanIt. We help regardless of whether you’re just getting started, an old pro, or paralyzed by fear, you’re at the right place. In this section on retirement savings, we explain how to calculate your savings. In other words, we help you (1) understand what the press defines as savings, and (2) how to figure out that number, and (3) how to look beyond that number to some equally important finance-related issues.

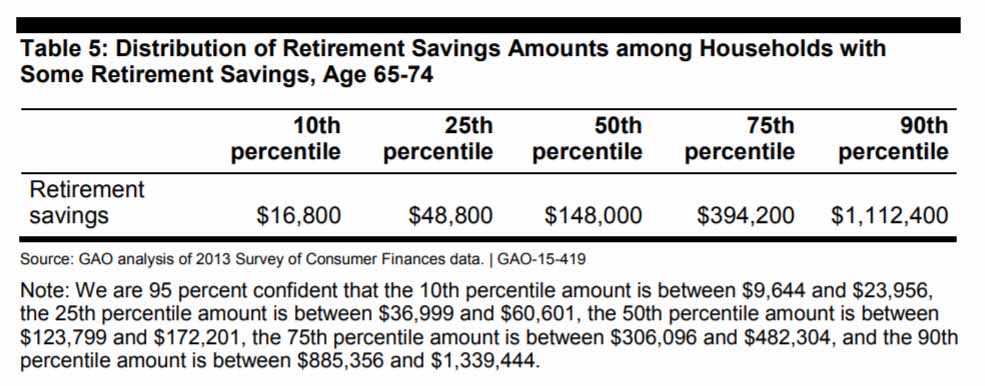

Remember, retirement savings is a pretty specific measurement that doesn’t include things like social security, home equity, and personal assets (cars, boats, ATVs, etc.) By this measure, the medium retirement savings in the US is about $120,000.

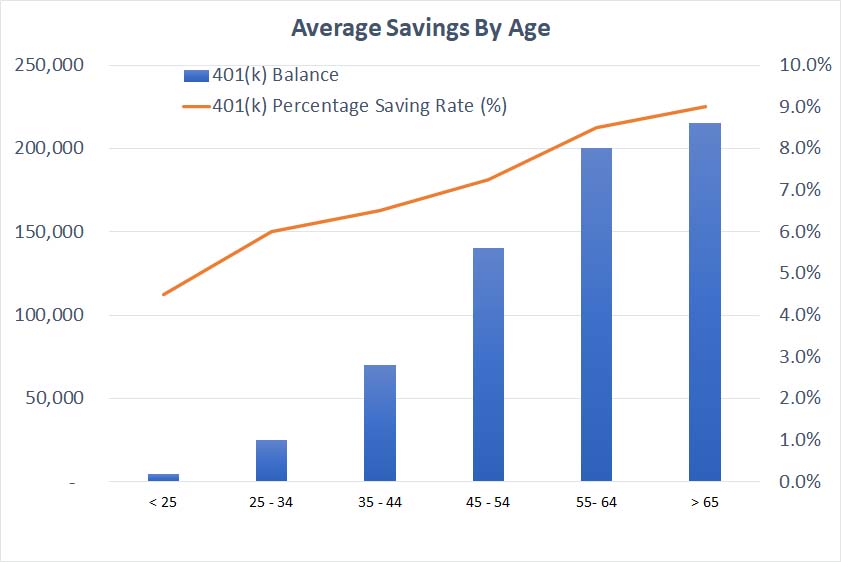

Retirement Savings By Age

Non-seniors should compare retirement savings by age. That’s because it is hard to compare savings across different age categories. For example, if you’re not a senior, take a look at the graph below. On the other hand, if you are a senior, jump to the paragraph below.

Senior Retirement Savings By Percentile

As a senior, it’s good to compare your savings to other seniors. The chart below is the United States Government Accountability Office breakdown into percentiles. The table below shows that 25% of us have less than $50,000. That’s good for the procrastinator and non-saver. There are lots of us. Alternatively, for you big savers, you can see where you fall in the percentile breakdown.

We created CarePlanIt to help everyone. In other words, we show everyone how to get into the game with a retirement financial plan. If you have a plan, this is great information to review. You can hone your skills and test your own knowledge.

Retirement Savings – Assets

Assets ate things you own, For example, stocks, bonds, annuities, homes,

Assets also include many other things. For example, most of us have what’s called illiquid assets. Assets that are valuable but assets that take time to convert to cash. These include antiques, art, collectibles, sports memorabilia, and jewelry. Depending on your taste and eye, these assets can be worth tens of thousands of dollars. Real estate also falls into this category.

Retirement Savings – Liabilities

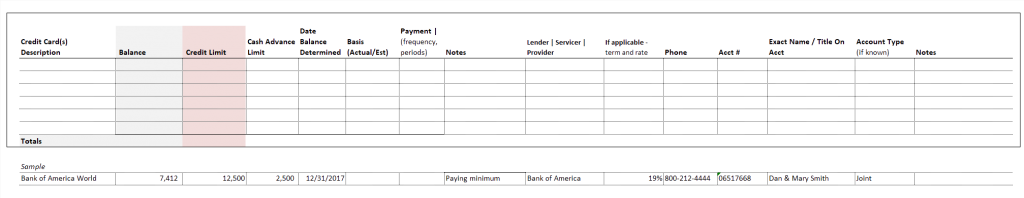

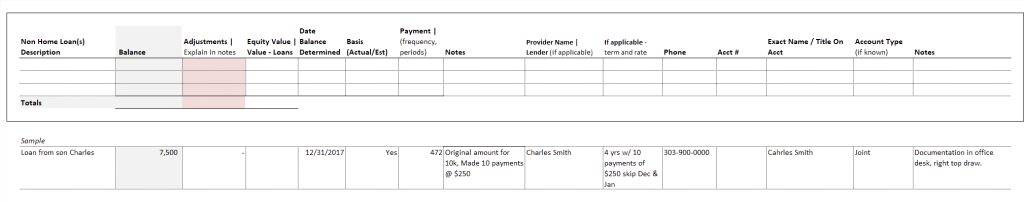

Unlike assets, liabilities aren’t a form of savings. In fact, you can think of them as anti-savings. They are loans. Things you need to pay back. Loans can be unsecured or secured. Unsecured loans include things like credit cards debt, college loans, and personal loans.

The most common liabilities and the ones that have a real effect on a person’s “net” worth are mortgage loans, credit card debt, and loans we co-sign (kid’s college debt, kid’s mortgage loans, etc.).

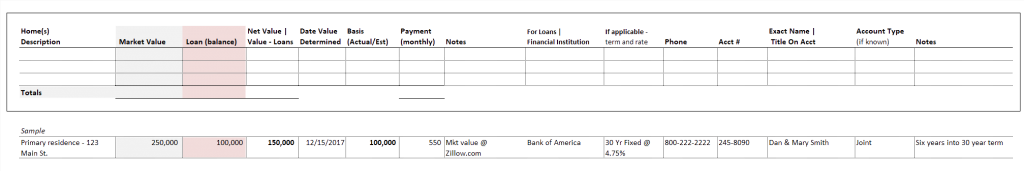

Putting It Together – Assets Minus Liabilities

Let’s look at things we own. Owning something doesn’t mean you own it without obligation. Homes and cars, for example, are often purchased with loans. Your ownership or at least the value of that ownership, is calculated by deducting what you owe on the car: the outstanding loan balance. What’s left is yours. Usually, by the time we retire, we’ve paid down loans and increased our retirement savings. This means if you know the market value, you can deduct any loans and determine your asset’s value. There are miscellaneous expenses and issues that often come into play, but for the most part, this is the basic equation.

You may have borrowed money to buy a home, car, or finance college. These are liabilities.

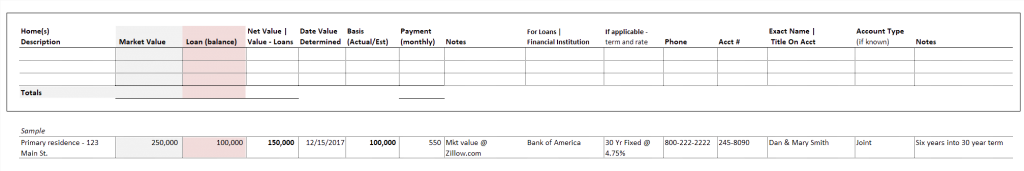

| Assets are highlighted in gray. |

| Liabilities are highlighted in red. |

Assets – What Seniors Own

For most people, if they own a home, it’s their largest asset and retirement saving. The market value minus any loans represents the equity in your home. In addition, basis is used to calculate tax liability on the sale of your home. Basis, for example, is the amount you spent to buy your home plus the costs of any provable improvements. (There are exemptions that eliminate taxes paid on gains from homes).

Home(s)

What do I need to track?

- Market value

- Loan amount

- Equity value

- Basis (for homes and investments; the amount paid plus additional expenses that change the basis)

- Loan information (if acquisition involved borrowing)

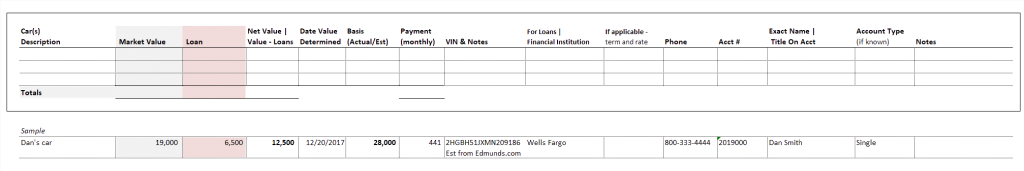

Cars

Just like homes, cars also have value.

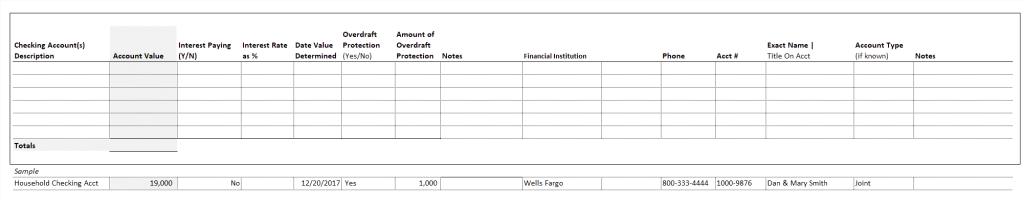

Checking Accounts

There is also value in checking accounts.

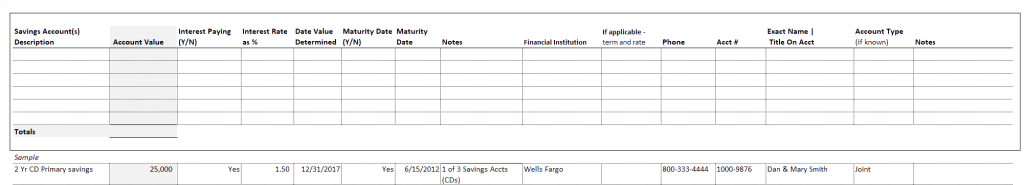

Savings Accounts

There is also value in savings accounts.

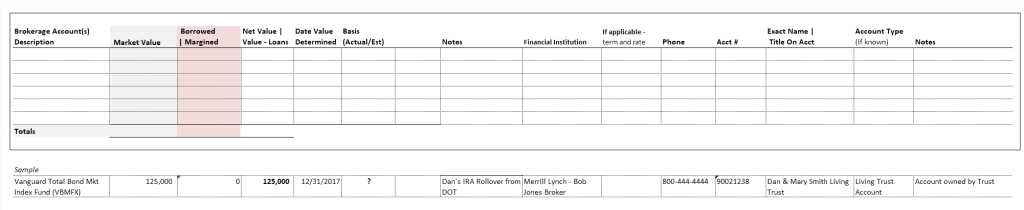

Brokerage Accounts

There is also value in brokerage account

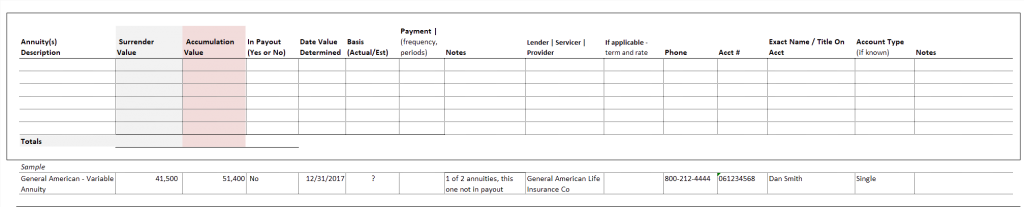

Annuities

Annuities also have value.

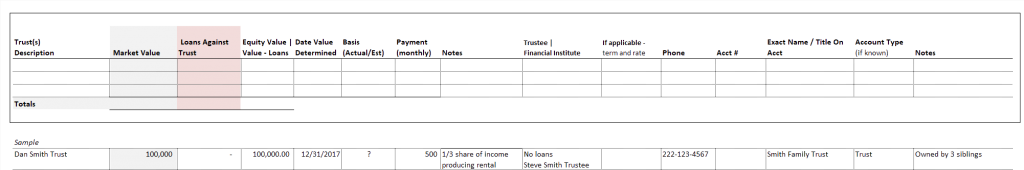

Trusts

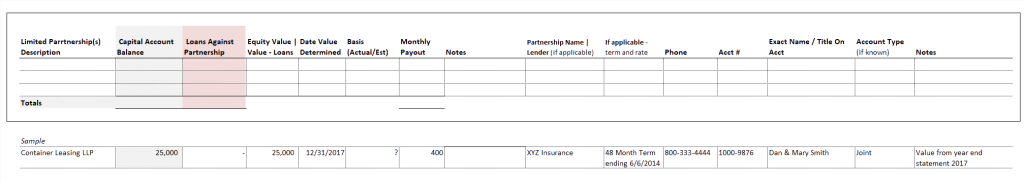

Limited & Other Partnerships

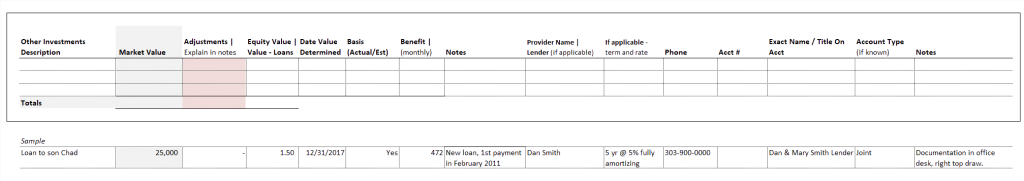

Other Assets

Liabilities – What Seniors Owe

Liabilities are what you owe. To properly calculate retirement savings, you need to subtract liabilities from assets. In other words, your net savings are your assets minus your liabilities.

Home Debt

Credit Cards

Other Loans

Emergency Situations

Very often we find ourselves in a situation where we need to quickly discover what a senior has and spends. We created a 24 Hour Emergency Audit that allows someone to quickly determine the financial situation of a senior. You can access it here.

Definitions

Single Accounts—one owner, no beneficiaries

Joint Accounts—two or more owners, no beneficiaries

POD (pay on death)/ITF (in trust for) Accounts—one or more owners, with named beneficiaries

Living Trust Accounts—held pursuant to a formal revocable trust account

Irrevocable Trust Accounts – held pursuant to a formal irrevocable trust account

IRA – Individual retirement account

Personal accounts also include deposits held in the name of a sole proprietorship.