CCRC Contract Type A – Care For Life

Click here to see what's on this page.

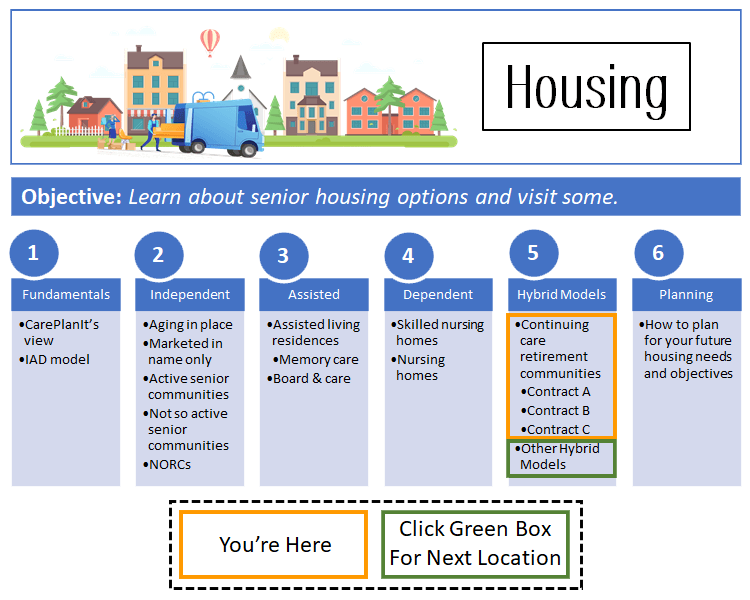

Continuing care retirement communities (CCRC) have three basic contracts and two outliers. Here we look at Type A or “Lifecare” contracts. Generally, you can ask any CCRC if they offer a Lifecare Contract. They will tell you if they do, or if they don’t.

Life Care Or CCRC Contract Type A

The best way to think about Lifecare contracts is that they offer care for life. For example, you may enter the CCRC in great health. Over time your health declines and you require assistance. So you move into the assisted living apartment complex on campus. Here, they have a restaurant, cleaning services, and aids that help you bathe. As more time elapses, you may require nursing care or long-term residential care. The Type A contract covers all these health levels and appropriate housing. In other words, as your needs increase, so do the services.

Costs of Type A Contracts

Type A contracts require large upfront buy-ins and monthly fees. Think of it like purchasing a home with a large down payment, and large monthly mortgage payments. The “buy-in” is usually between $750,000 and $2 million. Monthly fees can be between $1,500 and $3,500. But you’re paying this entrance fee and ongoing monthly fees in exchange for a lifetime of care.

The continuing care would include the whole range of services including additional care as needed. Part of the Agreement would include the transfer of the Ager from one type of housing (say independent) to a higher level of care (skilled nursing) as needed.

Under Type A Agreements, the CCRC incurs the majority of costs for the resident’s long-term care. Many Contract A arrangements even allow one spouse to move to a higher level of care while the other stays in the current environment. In short, the resident pays one big fee upfront, and in return, they get housing and medical services for life.

Equalized Pricing In CCRC Contract Type A

Is the CCRC on an equalized pricing schedule? Equalization means contract prices can be adjusted to current pricing when a resident moves from one type of housing to another. This type of pricing based on housing tends to equalize pricing among residents. However, it creates more volatility in the senior planning process.

Make Sure To Answer These Key Question

Lifecare contracts can differ. Before making any commitments, you should ensure the questions below are asked and answered.

Review The Other Contract Options

Before moving on, make sure you’ve also reviewed Contract B and Contract C. They are very different and have a substantial impact on short and long-term costs.