Life Plan Community – How To Evaluate

Click here to see what's on this page.

Life Plan Community is the modern name for a Continuing Care Retirement Community (CCRC). These communities offer a total plan for a senior and spouse. For example, a life plan community is a plan for all the senior’s residential and health needs. We discuss these communities in this section.

There are Only Three Ways To Live

There are only three ways to live: independent, assisted, and dependent. We call this CarePlanIt’s IAD model (IAD). Among these three options, a senior case manager would assess your ability to perform daily activities (ADLs and IADLs) to determine your best housing environment. See our view on housing here.

With this in mind, you can see how Life Plan Facilities act as a kind of senior case manager and provide housing options that match a senior’s abilities. Generally, you’ll start in independent housing and move housing options offering more care as your physical and cognitive abilities decline.

Life Plan Communities Address All Three Ways To Live

Life Plan Facilities offer all of these options. For example, management will often give their independent facilities elegant names, like Langford, Creekside, and Pineacres or refer to them as villages, cottages, and villas. Assisted living options, however, usually have assisted in the name. Finally, dependent care requires round-the-clock supervision. Consequently, this care is called residential care, nursing care, or skilled nursing care. Alzheimer’s and dementia care is called memory care, or Alzheimer’s and dementia care. Regardless, once you find a community, they will explain their different options.

How To Think About Life Plan Communities

Carmen and I started CarePlanIt because seniors were having trouble identifying their responsibilities. Turns out, they’re tied to our fears. Because of this, as we age, we avoid them. These fears are our responsibilities. They include money, health, housing, and becoming a burden on our children. Life Plan Communities mitigate these concerns. In other words, Life Plan Communities provide seniors and their families peace of mind.

Life Plan Community Resident Quote

I live in a Life Plan Community to play the game of life. My goal is to thrive, not die. I can do what I want without worrying about getting the care or where to live. Most seniors don’t understand these communities. They’re scared and filled with anxiety. They turn off their minds.

If I were a professional athlete, I’d have my team of nutritionists, doctors, and strength coaches. I’d live where I could stay healthy and strong. I’d live among like-minded athletes. My focus would be on playing my sport; staying in the game. I wouldn’t hide alone in my home where my health and welfare couldn’t be well monitored. That’s what a continuing care retirement community allows me to do.

What’s more, I know with confidence I won’t be a burden on my children. When they come to visit, we visit. We have a laugh, play and have fun. They aren’t worried about my future. They don’t play doctor or senior case manager. We don’t plan for my future care and well-being. It’s done!

CCRC Resident

The quote above demonstrates how secure the seniors feels. The quote also reflects how much better the resident’s family feels. In other words, life communities address the needs of the seniors and their families.

We cover continuing care retirement communities and their contract derivatives here. But keep reading this section to learn about the best way to evaluate a specific facility.

First Things To Keep In Mind About Life Plan Communities

There are a few things to keep in mind when delving into Life Plan Communities. For example, the big three are the terms of care over your lifetime, the specifics of your contract, and the financial viability of the community. We cover all these and will teach you about the details.

Terms Of Care

Care over your lifetime is why most seniors consider Life Plan Communities in the first place. Seniors want to know that all their IAD needs can be addressed. Life Plan Communities made this commitment to seniors. In other words, this is their unique selling proposition.

Terms of Contract

Your contract will define in detail what the community is providing you in terms of costs, care, and housing. There are three basic types; Type A, Type B, and Type C. On their face, they try and describe the communities commitment to the resident.

Firstly, Type A is for life care. You agree to an entrance and monthly fee that covers care and housing costs throughout your life. If your ability to pay the monthly fees runs out or doesn’t cover your costs, the community takes on the burden. Secondly, Type B is a modified life care contract that involves additional fees as one requires additional services. Additional fees are usually discounted to reflect the initial entrance fee. Thirdly, Type C is a fee-for-service agreement. Services are paid for at current rates. We explain them in this section, but we always encourage you to review a specific contract with a lawyer or a very smart family member.

Community Financial Viability

Also of concern is the community’s financial viability. However, financial viability is a difficult concept to understand. Here’s a way to quickly understand. Carmen and I used to live in Tennessee outside of Nashville in Franklin. All the adjacent land is privately owned. Consequently, we could buy it, mortgage it, and sell it. Today, Carmen and I live in Taos, New Mexico. Much of the adjacent land to our home is owned by a Native American Indian Tribe. It’s community-owned by all the members of the tribe. Thus, no one has the right to buy it, mortgage it, or sell it.

Many CCRCs are started by religious organizations. Often, the land is owned by the religious organization. It was likely donated by a member of the congregation along with restrictions of how it could be used, sold, or mortgaged. It had some of the characteristics of Indian land, at least in terms of the ease of mortgaging and selling. Also, once the CCRC was set up, other restrictions and limitations were placed on the land. The community by definition was making long-term commitments to its residents. These issues create challenges on how to leverage the land and property for financial purposes.

Forecasting Challenges

In addition to land and property leverage issues, the community itself often had to make complicated forecasts and estimates to properly set entrance and monthly fees to cover the lifetime costs of a resident’s care and housing. Many CCRCs made mistakes and are now insolvent. This means the costs of maintaining all of their commitments are greater than the money coming in from their residents.

Financial markets and government regulators are now addressing these issues. Remember that just because you’re upside down now, doesn’t mean you can’t raise rates for new residents. Once existing residents paying lower rates pass, the community is in a much better financial position. The point is simply that you should have your accountant examine the financial status of the Life PLan Community before you sign a contract. She can explain to you the issues and risks.

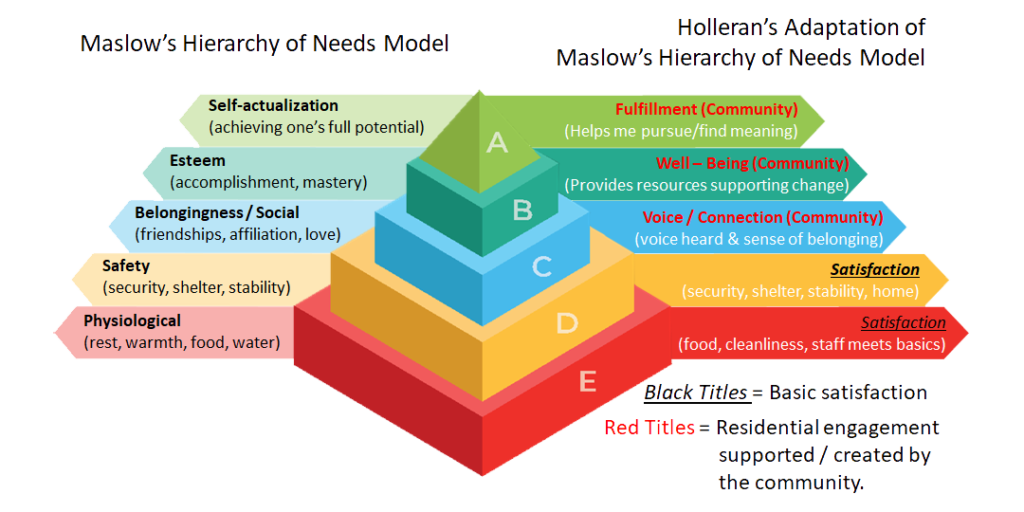

Resident Engagement Is A Great Measurement Tool For Life Time Communities

Before delving into the details of Life Plan Communities I want to mention how a leading consultancy measures these communities. The consultancy is Holleran Consulting. They adapted aspects of Maslow’s Hierarchy of Needs model and took these five levels of needs (from bottom to top): physiological (rest, warmth, food, water), safety (security, shelter, stability), belongingness/social (intimate relationships, friendships, affiliation), esteem (dignity, feelings of accomplishment, mastery), and self-actualization (transcendence, achieving one’s full potential); and aligned them with resident fulfillment. Holleran recognized that the Life Plan Communities that had the most fulfilled residents had their residents engaged in specific ways. Finally, Holleran matched those against Maslow’s Hierarchy of Needs model.

Looking Closely At Resident Needs Ensures Quality

Holleran divided up a Life Plan Community’s ability to address a resident’s needs into two broad sections: satisfaction and engagement. Satisfaction, for example, is about the basics of what any assisted or dependent senior facility offers. Things like food, quality of residence, staff rations, things to do, and the places they do them in. Do the residents feel safe, like the food, and enjoy their residences. Are they happy with the amenities and activities? These are the basics that a Life Plan Community provides. The things that address basic resident satisfaction.

The interesting dimensions that Holleran identifies fall in the category of engagement. For example, Holleran calls them voice, connection, well-being, and fulfillment. These represent resident engagement. Moreover, Holleran links engagement as necessary in a goal targeting self-actualization. In short, get resident engagement correct, and residents have a greater probability of reaching the highest rung of Maslow’s hierarchy of need.

Voice for example is engagement with the community. It involves a resident’s ability to choose what to do, their autonomy, their feelings of empowerment. Connection is engagement with other residents. This is the area of social connections and belonging. Well-being is engagement with health and wellness. As it relates to the whole person. For example, it includes physical, mental, spiritual, and social wellness. Fulfillment is engagement with life goals. What is the resident’s sense of purpose? In other words, having a purpose, big or small, is of critical importance in self-actualization. It can be as small as caring for a pet or as large as completing the great American novel.

Does The Life Plan Community You’re Investigating Address Engagement?

It’s a brilliant alignment of Maslow’s universal hierarchy of needs with a Life Plan Community’s highest objectives. It also provides anyone shopping for the best Life Plan Communities something to investigate. If you’re lucky, the community you’re investigating already works with Holleran. Even if they don’t you can ask questions related to key areas.

For example, find a resident and ask a few of the questions below.

Most facilities and residents don’t focus on these questions. So residents might find these questions hard to answer or give weird answers to the questions. That’s the most common response.

However, positive and knowledgeable answers to these questions indicate an engaged resident and a facility that likely encourages this engagement. These types of answers are an indication you’ve discovered something special.

Life Plan Community Basics

The Contract Is Key

The Life Plan Community or Continuing Care Retirement Community contract defines the relationship between the community and the resident. Contracts are defined by Type (A, B, C, and D). The contacts detail how the care is provided and correspond to lifecare, modified life care, fee for service, rental, and equity (co-op). The entrance fee for contracts Types A, B, and C defines the resident’s ability to access all levels and care and what that access costs. This Agreement defines everything and you must read it before signing. In fact, it’s important to review the agreement with a real estate lawyer. WE cover specific contract types here.

There are five key areas of the contract.

The Residence

The contract will literally list the residence you’re getting. It will have an actual address. Most residents start in independent living, but some enter into the assisted living facility. Regardless, you don’t own the residence. The community owns the residences. You get occupancy rights based on the terms of the contract. The resident section will define many of the issues below.

Entrance Fee or Buy-In

This is the large upfront fee. A resident pays this to enter the Life Plan Community. It funds the residences. As fees decline the quality of your residence goes down, and the communities commitment to your care decreases. The decrease in commitment is usually financial, not placement. The resident section will define many of the issues below.

Monthly Fee

The fee associated with your contract, and more specifically, the level of care and service provided. These fees cover the services provided to the resident. Independent living fees are closely related to housing, food, and recreation. For higher levels of assistance (e.g., assisted living, residential care, memory care, etc.), the monthly fees start picking up more health-related and ADL support costs.

Services Included

This section of the contract will detail included services. We’re focussing on independent living for this section.

Meals (Meal Plan)

Activities

Club And Facility Membership

Transportation

Housekeeping

Care Management / Care Coordination

Utilities

Maintenance

Religious Services

Health Clinic

Access To Non-Covered Health Services

Amenities & Common Facilities

Shared access to community amenities. They usually include physical structures, often dedicated to providing a specific service.

Food Venues

Shared Rooms And Spaces

Exercise And Sport Related

Gardens And Walkways

Beauty Related

Medical Related

Miscellaneous Contract Areas To Pay Special Attention To In Life Plan Communities

There are a few other areas of the contract to pay attention to. These involved fees for

Services Available At Additional Charges

Services uncovered in your monthly fees will vary depending on your level of care. For example, if you live in an independent facility, in-home care is extra. On the other hand, assisted living and residential care usually include in-home care. We’re focussing on independent living agreements here, so the “extras” below reflect this type of facility.

Resident Responsibilities

Residents of Life Plan Communities have obligations and responsibilities. For example, if you have recurring monthly fees, it is wise to place those on automatic payment. If there are guest restrictions, it’s good to let some close family members know what these are sop if they have to step in to help you, they know the rules governing their stays.

Common Residential Responsibilities Are Listed Below

Non Contract Areas Of Concern In Life Plan Communities

Life Plan Communities or continuing care retirement communities initially focussed on life care. The life care came with a tacit promise the resident will receive care for life, even if their initial entrance fees and monthly fees did not cover the current costs of health and housing services. This has created a situation where many CCRCs face periods of insolvency.

This is not a deal-breaker as long as the facility figures out how to plug or cover their temporary negative cash flow. Regardless, you should have your accountant review the facility’s financial disclosure documents. There are usually two or three of these and include: continuing care retirement community disclosure statement (a short 4-page document that some states now mandate), audited financials (a financial statement that an accredited accountant has audited), and a financial summary (they come in many varieties).

State Mandated Disclosure Statement

Most states now require CCRCs to make a basic financial disclosure available to the interested residents. This simple four-page form covers basic information like the number of units, services and amenities, entrance fee ranges, monthly fee range, and financial rations. You can see a copy here.

Disclosure Statement – As Referenced In A Resident Agreement

Most Resident Agreements will reference a financial statement or package. This financial statement or package describes the facility, the management, and the financials. Sometimes it has audited financial statements, sometimes, it does. You can see a sample copy here.

Audited Facility Financials

Audited financials are the best financial resource you can obtain to assess the financial viability of a CCRC. These reports will include balance sheet and cash flow information. You can see a sample copy here.

Contract Details

You can review specific contract details in these sections: Contract A, Contract B, and Contract C. They are very different and have a substantial impact on short and long-term costs.