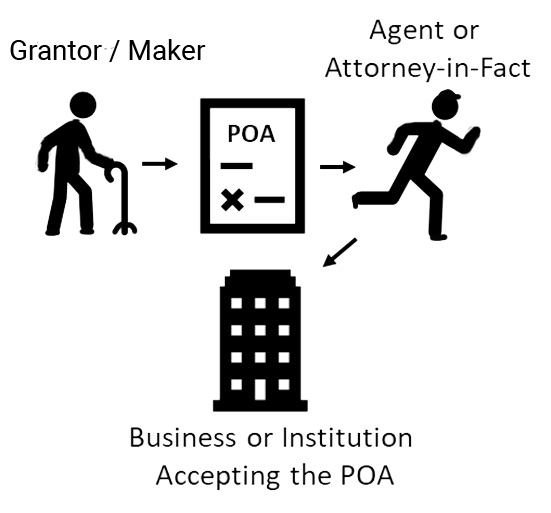

General Power of Attorney

A “General” Power of Attorney or GPOA focuses on the notion of general and usually covers non-medical situations. They fall into financial, family, business, and legal matters. We’ll show you a list of possible non-medical tasks below.

Please see our section on Advance Medical Directives fro a detailed explanation.

Senior’s should think about a general power of attorney for situations that might allow a trusted child or adviser (lawyer, accountant, etc.) to make complex decisions on their behalf. Seniors that aren;t trained in taxes, finances, or law may have difficulty gathering and undertsabidng all the details needed to make a good decision. Moreover, it may be unrealistic to expect these decisions to be made quickly. In other words, requiring the senior to be fully informed and given the necessary time to make a good decions may limit the value of having an expert in the first palce.

Durable Versus Non-Durable Power of Attorney

However, it’s worth noting that there are two types of POAs: durable and non-durable. A durable POA differs from a regular or non-durable POA in how the powers are treated after the POA grantor/maker becomes disabled or incompetent. A regular POA essentially terminates when the Grantor becomes disabled or incompetent.

A durable POA allows the agent to continue to make decisions for the grantor/maker.

Common Issues Addressed

General POAs allow a grantor to appoint a agent to make lots of decisions on their behalf.

Common Tasks In A POA

See Advance Medical Directives Section.